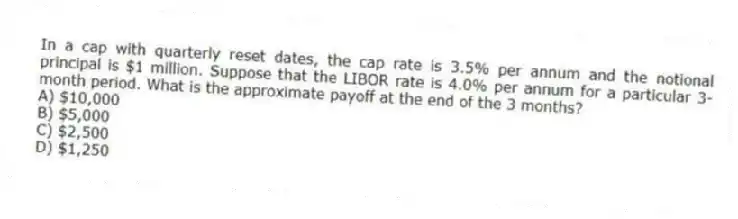

In a cap with quarterly reset dates, the cap rate is 3.5% per annum and the notional principal is $1 million. Suppose that the LIBOR rate is 4.0% per annum for a particular 3-month period. What is the approximate payoff at the end of the 3 months?

A) $10,000

B) $5,000

C) $2,500

D) $1,250

Correct Answer:

Verified

Q10: What is exchanged when a put option

Q11: A five-year cap is reset annually period.

Q12: A floating-rate lender wants to use a

Q13: At the maturity of a bond option,

Q14: Which of the following is assumed to

Q15: Which of the following is an implication

Q16: Which of the following is assumed to

Q17: Which of the following is true?

A) A

Q18: Which of the following is true?

A) A

Q19: Which of the following is true?

A) A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents