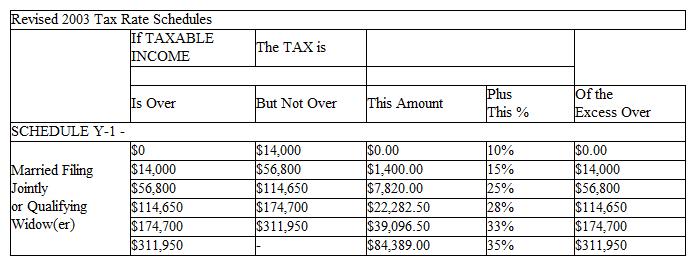

Raul has an adjusted income of $153,850, is married, and files jointly. Compute his tax.

A) $32,082.50

B) $10,976.00

C) $33,258.50

D) $22,282.50

E) $22,377.50

Correct Answer:

Verified

Q1: Which of the following illustrations is a

Q2: To the nearest two million, how many

Q3: If the symbol Q4: Which of the following illustrations is a Q5: Find the mean of the list of Q7: Which of the following illustrations is a Q8: Refer to the line graph. Q9: Match the type of information with the Q10: Refer to the pie graph that shows Q11: Refer to the pictograph.![]()

At what times

How much more money

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents