Short Answer

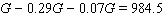

If 29% of your monthly pay is withheld for federal income taxes and another 7% is withheld for Social Security, state income tax, and other miscellaneous items, leaving you with $984.50 a month in take-home pay, then the amount you earned before the deductions were removed from your check is given by the equation  . Solve this equation to find your gross income. Round the answer to the nearest dollar. $ __________ per month

. Solve this equation to find your gross income. Round the answer to the nearest dollar. $ __________ per month

Correct Answer:

Verified

Related Questions