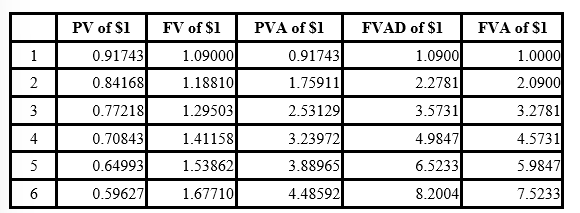

Present and future value tables of $1 at 9% are presented below.

-An investment product promises to pay $42,000 at the end of 10 years. If an investor feels this investment should produce a rate of return of 12%, compounded annually, what's the most the investor should be willing to pay for the investment?

A) $15,146.

B) $13,523.

C) $42,000.

D) $130,446.

Correct Answer:

Verified

Q53: To determine the future value factor for

Q54: Present and future value tables of $1

Q55: Present and future value tables of $1

Q56: Loan A has the same original principal,

Q57: Mary Alice just won the lottery and

Q59: Present and future value tables of $1

Q60: Which of the following must be known

Q61: Tammy wants to buy a car that

Q62: The note about debt included in the

Q63: The note about debt included in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents