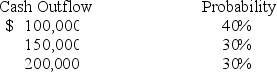

Simpson Mining is obligated to restore leased land to its original condition after its excavation activities are completed in three years. The cash flow possibilities and probabilities for the restoration costs in three years are as follows:  The company's credit-adjusted risk-free interest rate is 5%. The liability that Simpson must record at the beginning of the project for the restoration costs is: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

The company's credit-adjusted risk-free interest rate is 5%. The liability that Simpson must record at the beginning of the project for the restoration costs is: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

A) $129,576.

B) $145,000.

C) $125,257.

D) $172,768.

Correct Answer:

Verified

Q37: Below are excerpts from time value of

Q38: Present and future value tables of $1

Q39: Present and future value tables of $1

Q40: Present and future value tables of $1

Q41: Present and future value tables of $1

Q43: An investor purchases a 20-year, $1,000 par

Q44: Yamaha Inc. hires a new chief financial

Q45: Zulu Corporation hires a new chief executive

Q46: Present and future value tables of $1

Q47: A series of equal periodic payments that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents