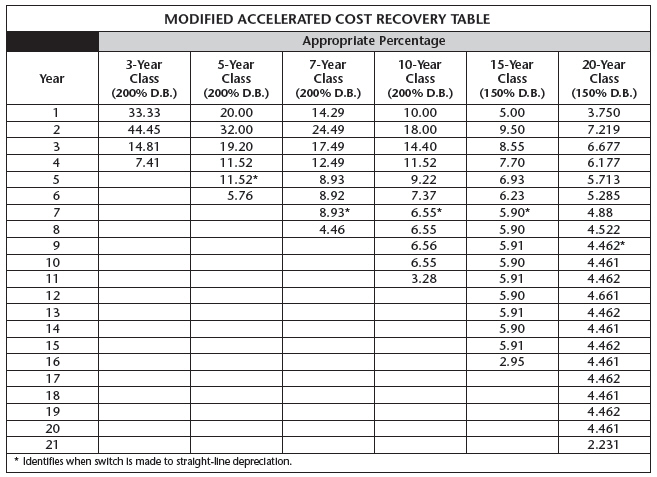

Stephanie purchased a pickup truck that cost $22,400 and has a salvage value of $3,000. Stephanie plans to use the truck 80% for business purposes and 20% for personal use. What is the fourth-year depreciation? Use the MACRS method.

Correct Answer:

Verified

$22,400 * 80% = $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: The Modified Accelerated Cost Recovery System (MACRS)

Q29: The rate of depreciation is obtained by

Q30: What is the third-year depreciation of a

Q31: The life of a toaster oven is

Q32: The original cost of a jet ski

Q34: What depreciation class is used for the

Q35: Paul purchased a mobile home that originally

Q36: The life of a semitruck is 11

Q37: The original cost of a Jeep was

Q38: Dawn bought a van at the beginning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents