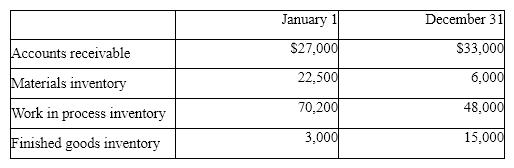

Davis Manufacturing Company had the following data:

Collections on account were $625,000.

Cost of goods sold was 68% of sales.

Direct materials purchased amounted to $90,000.

Factory overhead was 300% of the cost of direct labor.

Compute:

(a) Sales revenue (all sales were on account)

(b) Cost of goods sold

(c) Cost of goods manufactured

(d) Direct labor used

(e) Direct materials incurred

(f) Factory overhead incurred

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Which of the following would be least

Q156: The following information is available for Carter

Q161: Watson Company has the following data:

Q162: Classify the following costs as either a

Q164: The Zoe Corporation has the following information

Q168: Magnus Industries has the following data:

Q169: For each of the following, indicate whether

Q170: Zoe Corporation has the following information for

Q179: Laramie Technologies had the following data:

Cost of

Q244: Allen Company used $71,000 of direct materials

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents