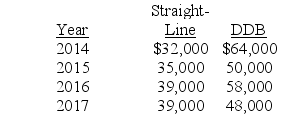

Gonzaga Company has used the double-declining-balance method for depreciation since it started business in 2014. At the beginning of 2018, the company decided to change to the straight-line method. Depreciation as reported and what it would have been reported if the company had always used straight-line is listed below:  Required:

Required:

What journal entry, if any, should Gonzaga make to record the effect of the accounting change (ignore income taxes)? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q191: Meca Concrete purchased a mixer on January

Q192: McLean Mfg. Company sold a three-speed lathe

Q193: El Dorado Foods Inc. owns a chain

Q194: In 2017, Dooling Corporation acquired Oxford Inc.

Q195: Zvinakis Mining Company paid $200,000 for the

Q197: Eckland Manufacturing Co. purchased equipment on January

Q198: The table below contains data on depreciation

Q199: In its 2018 annual report to shareholders,

Q200: In its 2018 annual report to shareholders,

Q201: (Note: The following problem requires students

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents