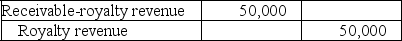

Johnson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Johnson accrued royalty revenue of $50,000 on December 31, 2017, as follows:  Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Required:

Prepare any journal entries Johnson should record during 2018 related to the royalty revenue.

Correct Answer:

Verified

Q125: Name and briefly describe the three categories

Q126: Describe briefly the approaches of reporting changes

Q127: B Co. reported a deferred tax liability

Q128: Colorado Consulting Company has been using the

Q129: Pinnacle Corporation has been using the straight-line

Q131: A company changes depreciation methods. Briefly describe

Q132: Buckeye Company purchased a machine on January

Q133: Nash Industries changed its method of accounting

Q134: Mattson Company receives royalties on a patent

Q135: Annual depreciation expense on a building purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents