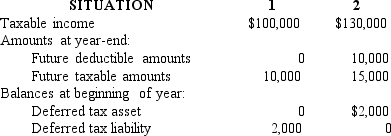

Two independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a. )Income tax payable currently.

(b. )Deferred tax asset - balance at year-end.

(c. )Deferred tax asset change dr or (cr)for the year.

(d. )Deferred tax liability - balance at year-end.

(e. )Deferred tax liability change dr or (cr)for the year.

(f. )Income tax expense for the year.

Correct Answer:

Verified

Q124: Use the following to answer questions

In

Q126: Required:

Prepare a compound journal entry to record

Q128: EZ, Inc., reports pretax accounting income of

Q129: Gallo Light began operations in 2016.The company

Q132: Gore Company,organized on January 2,2016,had pretax accounting

Q133: The information that follows pertains to Julia

Q141: In the current year, Bruno Corporation collected

Q152: Pocus, Inc., reports warranty expense when related

Q153: At the end of the prior year,

Q158: At the end of its first year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents