In its 2018 annual report to shareholders, Black Inc. disclosed the following information about income taxes.

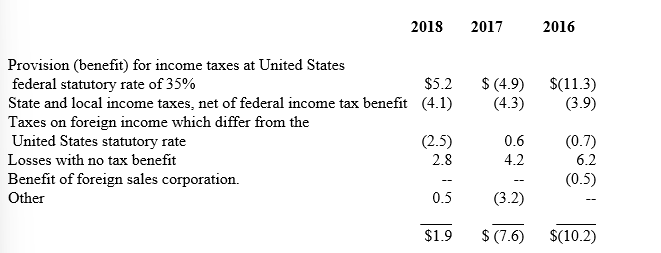

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the provision (benefit) for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31, 2018, 2017, and 2016 is as follows ($ in millions):

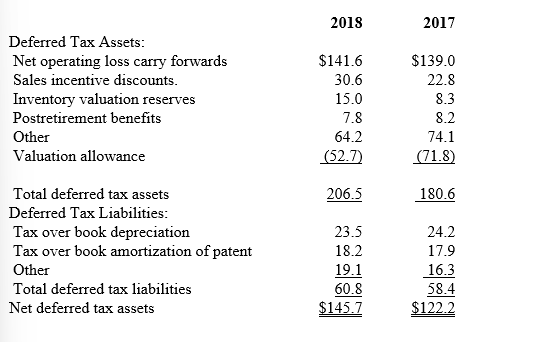

The significant components of the net deferred tax assets at December 31, 2018 and 2017 were as follows ($ in millions):

-Estimate the effective tax rate for Black Inc. in 2018. Why is it different from the 35% federal statutory rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Listed below are 5 terms followed by

Q132: Listed below are 5 terms followed by

Q133: Listed below are five independent situations. For

Q134: Listed below are five independent situations. For

Q135: The following information is for Hulk Gyms'

Q137: Listed below are 5 terms followed by

Q138: Listed below are five independent situations. For

Q139: Listed below are five independent situations. For

Q140: Listed below are 5 terms followed by

Q141: In the current year, Bruno Corporation collected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents