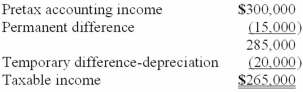

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Tringali's tax rate is 40%. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

A) $35,000.

B) $20,000.

C) $14,000.

D) $8,000.

Correct Answer:

Verified

Q7: Which of the following causes a temporary

Q8: Future taxable amounts result in deferred tax

Q10: Which of the following differences between financial

Q14: A result of inter-period tax allocation is

Q14: For its first year of operations, Tringali

Q15: The tax benefit of a net operating

Q17: Which of the following usually results in

Q18: Changes in enacted tax rates that do

Q26: Which of the following circumstances creates a

Q27: Which of the following creates a deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents