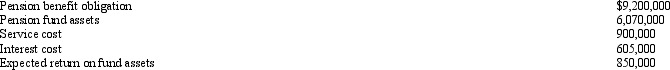

The following information relates to the defined benefit pension plan of Williams Corporation for the year ending December 31, 2012:  What is the net pension expense for Williams Corporation in 2012?

What is the net pension expense for Williams Corporation in 2012?

A) $1,145,000

B) $605,000

C) $900,000

D) $655,000

Correct Answer:

Verified

Q30: The earnings from assets in a company's

Q31: A pension fund is "under-funded" when the

A)

Q32: Which type of pension plan requires a

Q33: Which of the following is NOT a

Q34: Deferred income taxes arise from

A) Differences between

Q36: Which type of pension plan promises employees

Q37: Sales Taxes Payable is normally classified as

Q38: A cash compensation received by an employee

Q39: Income taxes shown on the income statement

Q40: The yearly increase in the pension obligation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents