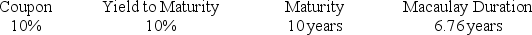

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

If the yield to maturity decreases to 8.045%, the expected percentage change in the price of the bond using modified duration would be ________.

A) 11%

B) 13%

C) 12%

D) 10%

Correct Answer:

Verified

Q61: Immunization of coupon-paying bonds does not imply

Q62: If an investment returns a higher percentage

Q63: You have an investment horizon of 6

Q64: Advantages of cash flow matching and dedicated

Q65: You have an investment horizon of 6

Q67: Market economists all predict a rise in

Q68: You have an investment that in today's

Q69: Steel Pier Company has issued bonds that

Q70: A zero-coupon bond is selling at a

Q71: You have an investment horizon of 6

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents