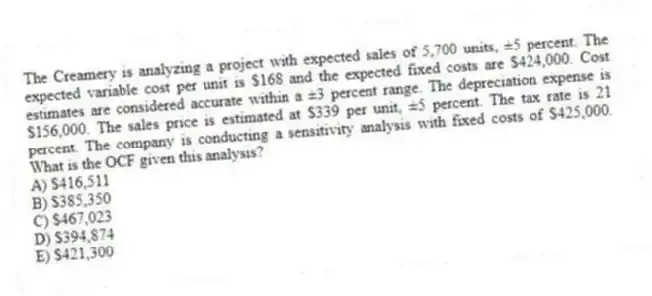

The Creamery is analyzing a project with expected sales of 5,700 units, ±5 percent. The expected variable cost per unit is $168 and the expected fixed costs are $424,000. Cost estimates are considered accurate within a ±3 percent range. The depreciation expense is $156,000. The sales price is estimated at $339 per unit, ±5 percent. The tax rate is 21 percent. The company is conducting a sensitivity analysis with fixed costs of $425,000. What is the OCF given this analysis?

A) $416,511

B) $385,350

C) $467,023

D) $394,874

E) $421,300

Correct Answer:

Verified

Q67: Shoe Supply has decided to produce a

Q68: Your company is reviewing a project with

Q69: Stellar Plastics is analyzing a proposed project

Q70: You are considering a new product launch.

Q71: Consider a 5-year project with an initial

Q73: A project has an accounting break-even point

Q74: At the accounting break-even point, Swiss Mountain

Q75: The accounting break-even production quantity for a

Q76: Assume a project has a sales quantity

Q77: A proposed project has fixed costs of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents