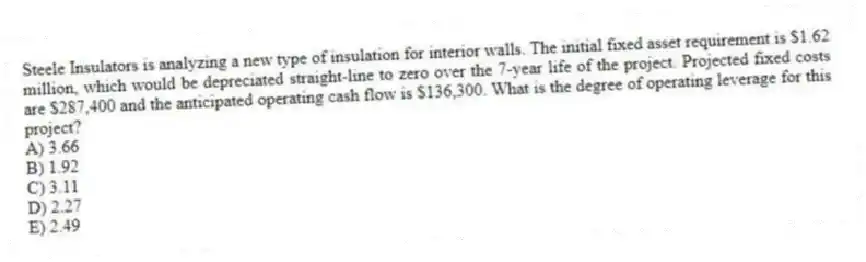

Steele Insulators is analyzing a new type of insulation for interior walls. The initial fixed asset requirement is $1.62 million, which would be depreciated straight-line to zero over the 7-year life of the project. Projected fixed costs are $287,400 and the anticipated operating cash flow is $136,300. What is the degree of operating leverage for this project?

A) 3.66

B) 1.92

C) 3.11

D) 2.27

E) 2.49

Correct Answer:

Verified

Q88: You are in charge of a project

Q89: A project has an accounting break-even quantity

Q90: You are the manager of a project

Q91: A project has an estimated sales price

Q92: A company is considering a project with

Q94: You have determined that an OCF of

Q95: A project has a unit price of

Q96: At an output level of 22,500 units,

Q97: The Motor Works is considering an expansion

Q98: A project has a contribution margin per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents