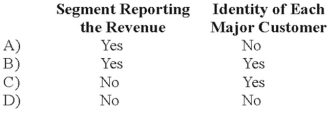

Stone Company reported $100,000,000 of revenues on its 20X8 income statement. During the year ended December 31, 20X8, Stone made sales of $8,000,000 to external customers in Western Europe. In addition, Stone made sales of $10,000,000 to the U.S. government and $4,000,000 of sales to various state governments. In the footnotes to its financial statements for 20X8, in reporting enterprisewide disclosures, Stone is required to disclose:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q28: On June 30,20X8,String Corporation incurred a $220,000

Q31: Forge Company, a calendar-year entity, had 6,000

Q32: Collins Company reported consolidated revenue of $120,000,000

Q34: On March 15,20X9,Clarion Company paid property taxes

Q34: Forge Company, a calendar-year entity, had 6,000

Q37: Wakefield Company uses a perpetual inventory system.

Q38: Wakefield Company uses a perpetual inventory system.

Q39: Note: This is a Kaplan CPA Review

Q51: Derby Company pays its executives a bonus

Q57: Which of the following observations is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents