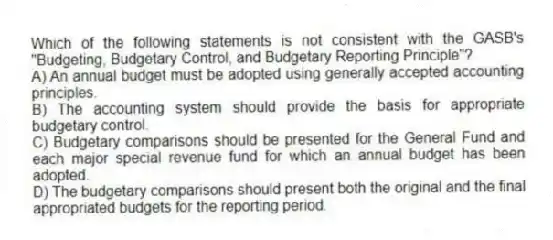

Which of the following statements is not consistent with the GASB's "Budgeting, Budgetary Control, and Budgetary Reporting Principle"?

A) An annual budget must be adopted using generally accepted accounting principles.

B) The accounting system should provide the basis for appropriate budgetary control.

C) Budgetary comparisons should be presented for the General Fund and each major special revenue fund for which an annual budget has been adopted.

D) The budgetary comparisons should present both the original and the final appropriated budgets for the reporting period.

Correct Answer:

Verified

Q28: Under certain circumstances a cost generally unallowable

Q29: In budgeting revenues, state and local government

Q30: A budgeting method that derives the subsequent

Q31: Cash disbursement budgets:

A) Are prepared to facilitate

Q32: Governments receiving federal grants and contract funds

Q34: Service efforts and accomplishments reporting is also

Q35: The United States Office of Management and

Q36: The GASB "Budgeting Principle" states that an

Q37: GASB Concepts Statement No. 2 requires state

Q38: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents