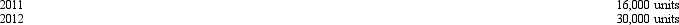

Wings Manufacturing Company purchased a new machine on July 1, 2011. It was expected to produce 200,000 units of product over its estimated useful life of eight years. Total cost of the machine was $600,000, and salvage value was estimated to be $60,000. Actual units produced by the machine in 2011 and 2012 are shown below:  Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

A) $124,200

B) $90,000

C) $81,000

D) $74,520

Correct Answer:

Verified

Q40: Which of the following assets is NOT

Q41: In order to calculate periodic depreciation expense,

Q42: Rapid Deliveries purchased a delivery truck on

Q43: Coppola Company purchased a machine on January

Q44: On January 1, 2012, Salina Company purchased

Q46: Which of the following is a criterion

Q47: On January 1, 2012, Brown Company purchased

Q48: On January 1, 2012, Bushong Company purchased

Q49: The entry to record a gain on

Q50: If a truck's engine is overhauled for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents