Exhibit 20-2

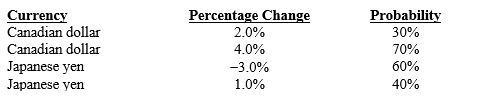

Luzar Corporation decides to borrow 50 percent of funds needed in Canadian dollars and the remainder in yen. The U.S. (domestic) financing rate for a one-year loan is 7 percent. The Canadian one-year interest rate is 6 percent, and the Japanese one-year interest rate is 10 percent. Luzar has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 20-2 above. What is the probability that the financing rate of the two-currency portfolio is less than the domestic financing rate?

A) 12 Percent

B) 30 Percent

C) 100 Percent

D) 0 Percent

E) none of the above

Correct Answer:

Verified

Q6: If all currencies in a financing portfolio

Q9: Firms that believe the forward rate is

Q16: If interest rate parity exists, financing with

Q18: The interest rate of Euronotes is based

Q19: One reason an MNC may consider foreign

Q28: Assume that interest rate parity holds between

Q30: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q31: Exhibit 20-1

Assume a U.S.-based MNC is borrowing

Q35: Maston Corporation has forecasted the value of

Q37: If interest rate parity exists, the attempt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents