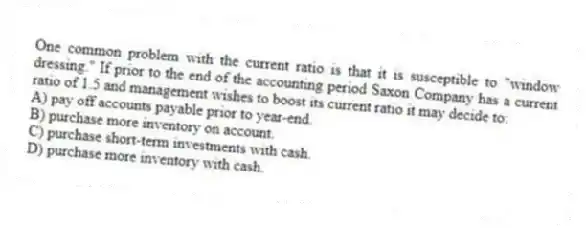

One common problem with the current ratio is that it is susceptible to "window dressing." If prior to the end of the accounting period Saxon Company has a current ratio of 1.5 and management wishes to boost its current ratio it may decide to:

A) pay off accounts payable prior to year-end.

B) purchase more inventory on account.

C) purchase short-term investments with cash.

D) purchase more inventory with cash.

Correct Answer:

Verified

Q1: Which of the following ratios is not

Q2: Market equity beta measures the covariability of

Q3: Mobile Company

Mobile Company manufactures computer technology

Q4: Doran Corp.has a current ratio of 6.Under

Q5: The Johnson Company has a current ratio

Q7: Bankruptcy prediction research has identified three broad

Q8: Mobile Company

Mobile Company manufactures computer technology

Q9: Mobile Company

Mobile Company manufactures computer technology

Q10: If a customer wanted to obtain bank

Q11: Which of the following is not one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents