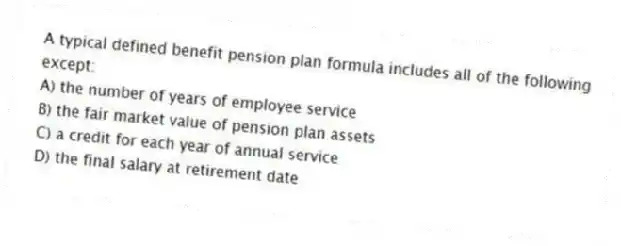

A typical defined benefit pension plan formula includes all of the following except:

A) the number of years of employee service

B) the fair market value of pension plan assets

C) a credit for each year of annual service

D) the final salary at retirement date

Correct Answer:

Verified

Q24: Typical U.S.GAAP disclosures for deferred income taxes

Q25: Dividing a company's income tax expense by

Q26: All of the following examples represent complex

Q27: Deferred tax assets result in future tax

Q28: All of the following are most likely

Q30: Under the completed contract method:

A) revenue and

Q31: Which of the following would not be

Q32: Regarding actuarial assumptions,firms must disclose in notes

Q33: Upton Company has consistently used the

Q34: The _ is equal to the actuarial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents