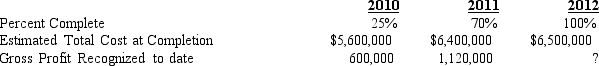

Bower Construction Comp.has consistently used the percentage-of-completion method for recognizing revenue on its long-term contracts.During 2010 Bower entered into a fixed-price contract to construct an office building for $8,000,000.Information relating to the contract is as follows:

Required (Show Calculations):

1.Compute contract costs incurred during 2010,2011 and 2012.

2.Determine how much gross profit Bower should recognize in 2012.

3.Under what conditions would it not be reasonable for a company to use the percentage of completion method of recognizing revenue on long-term contracts?

4.If Bower had used the completed contract method of accounting for this long-term contract how much gross profit would it have earned in 2010,2011 and 2012?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: _ is primarily a question of timing.

Q49: A company that uses FIFO will find

Q50: A company that uses LIFO will find

Q65: Firm A places its order for the

Q80: When cash collectibility is uncertain the _

Q81: Given the following information,compute December 31,2012

Q83: Many firms use derivative instruments to hedge

Q84: Magnum Construction contracted to construct a

Q85: The following information is related to the

Q86: The following information is taken from Satin

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents