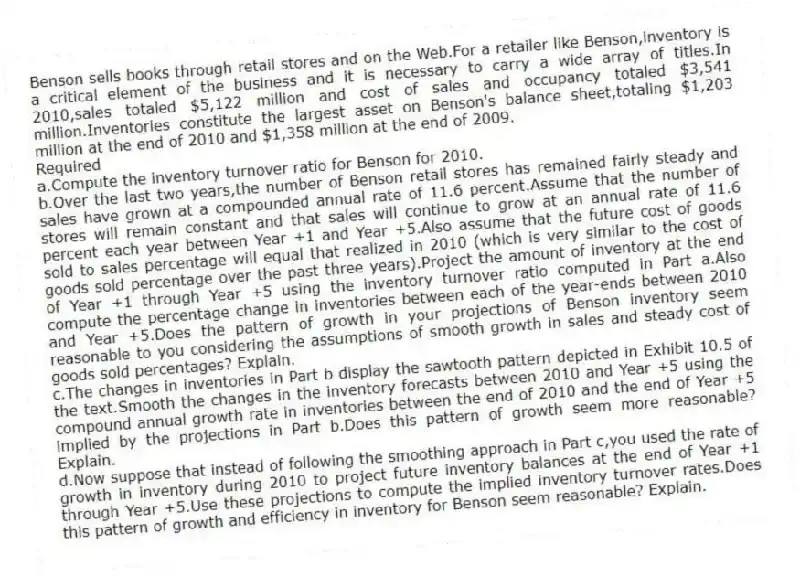

Benson sells books through retail stores and on the Web.For a retailer like Benson,inventory is a critical element of the business and it is necessary to carry a wide array of titles.In 2010,sales totaled $5,122 million and cost of sales and occupancy totaled $3,541 million.Inventories constitute the largest asset on Benson's balance sheet,totaling $1,203 million at the end of 2010 and $1,358 million at the end of 2009.

Required

a.Compute the inventory turnover ratio for Benson for 2010.

b.Over the last two years,the number of Benson retail stores has remained fairly steady and sales have grown at a compounded annual rate of 11.6 percent.Assume that the number of stores will remain constant and that sales will continue to grow at an annual rate of 11.6 percent each year between Year +1 and Year +5.Also assume that the future cost of goods sold to sales percentage will equal that realized in 2010 (which is very similar to the cost of goods sold percentage over the past three years).Project the amount of inventory at the end of Year +1 through Year +5 using the inventory turnover ratio computed in Part a.Also compute the percentage change in inventories between each of the year-ends between 2010 and Year +5.Does the pattern of growth in your projections of Benson inventory seem reasonable to you considering the assumptions of smooth growth in sales and steady cost of goods sold percentages? Explain.

c.The changes in inventories in Part b display the sawtooth pattern depicted in Exhibit 10.5 of the text.Smooth the changes in the inventory forecasts between 2010 and Year +5 using the compound annual growth rate in inventories between the end of 2010 and the end of Year +5 implied by the projections in Part b.Does this pattern of growth seem more reasonable? Explain.

d.Now suppose that instead of following the smoothing approach in Part c,you used the rate of growth in inventory during 2010 to project future inventory balances at the end of Year +1 through Year +5.Use these projections to compute the implied inventory turnover rates.Does this pattern of growth and efficiency in inventory for Benson seem reasonable? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Techtronics is a leader in manufacturing

Q54: The authors set forth a seven-step forecasting

Q55: Repair Specialists is a leading retailer

Q56: A firm in transition from the high

Q57: The following information about Douglas Corp.'s

Q58: Simmons Company

These data represent a summary

Q59: Arco is an integrated manufacturer in

Q60: In comparison of 2010 to 2009 performance,Watson

Q61: Saunders Corporation manufactures consumer electronics products.Selected

Q63: Hart designs,manufactures,and markets toys in domestic and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents