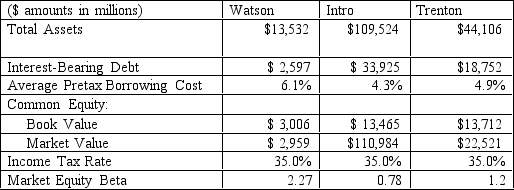

Watson manufactures and sells appliances.Intro develops and manufactures computer technology.Trenton operates general merchandise retail stores.Selected data for these companies appear in the following table (dollar amounts in millions).For each firm,assume that the market value of the debt equals its book value.

Required: a.Assume that the intermediate-term yields on U.S.Treasury securities

are roughly 3.5 percent.Assume that the market risk premium is 5.0 percent.

Compute the cost of equity capital for each of the three companies.

b.Compute the weighted average cost of capital for each of the three companies.

c.Compute the unlevered market (asset)beta for each of the three companies.

Correct Answer:

Verified

Note that Watson has the highest weigh...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Why are dividends value-relevant to common equity

Q38: Identify the types of firm-specific factors that

Q40: Why do investors typically accept a lower

Q42: For each of the following scenarios determine

Q42: Conceptually,why should an analyst expect the dividends

Q44: Shady Sunglasses operates retail sunglass kiosks in

Q44: The dividends valuation approach measures value-relevant dividends

Q45: For each of the following companies,determine the

Q48: Carr Industries must raise $100 million on

Q50: According to the text,dividends are value-relevant even

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents