_____ At 12/31/06, Pivlex had a $60,000 dividend receivable on its books from its foreign subsidiary. The dividend of 100,000 LCUs was declared on 12/28/06, when the direct exchange rate was $.60. The dividend was remitted to Pivlex on 1/8/07, when the direct exchange rate was $.62. The direct exchange rate at 12/31/06 was $.59. Pivlex uses the temporal method of translation. At 12/31/06, Pivlex should

A) Adjust the Dividend Receivable account downward and debit OCI-Translation Adjustment for $1,000.

B) Adjust the Dividend Receivable account downward and debit FX Transac-tion Loss for $1,000.

C) Make no adjustment to the Dividend Receivable account.

D) Adjust the Dividend Receivable account upward by $2,000.

E) None of the above.

Correct Answer:

Verified

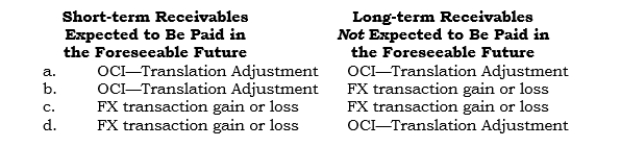

Q91: _ The U.S. dollar is the functional

Q92: _ The U.S. dollar is the functional

Q93: _ Poomax has a long-term intercompany receivable

Q94: _ Povax has a long-term intercompany receivable

Q95: _ Pevex has an intercompany receivable denominated

Q97: _ During 2006, Pavlox had intercompany sales

Q98: _ Petex's Swiss subsidiary, Setex, sold inventory

Q99: _ A parent owns a foreign subsidiary

Q100: _ How can the risk of investing

Q101: _ Which of the following items is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents