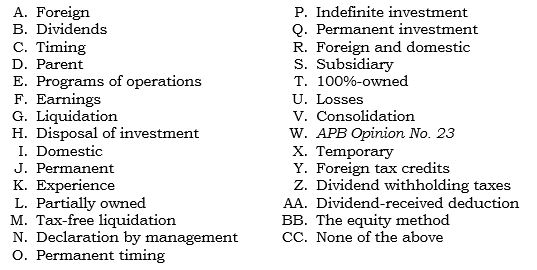

Using the following answer code, select the proper letter(s) and insert it (them) in the space provided:

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

b. _____ _____ The category of subsidiary to which the 100% dividend received deduction is applicable.

c. _____ _____ The two examples of evidence required to satisfy the conditions for indefinite investment.

d. _____ _____ On whose books are dividend withholding taxes recorded?

e. _____ _____ The type of subsidiary with which a domestic parent can file a consolidated income tax return. (This does not pertain to ownership percentage; the answer is not T.)

f. _____ _____ Something that is applicable only to foreign subsidiaries.

Correct Answer:

Verified

Q169: _ Panex owns 100% of the outstanding

Q170: _ Panex owns 100% of the outstanding

Q171: _ Panex owns 100% of the outstanding

Q172: _ Use the same information as in

Q173: _ A foreign subsidiary located in Ireland

Q175: Popp owns 100% of the outstanding common

Q176: Panex owns 100% of the outstanding common

Q177: Long-term exchange rate changes are best explained

Q178: The focus of the PPP current-value approach

Q179: A problem that can occur under both

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents