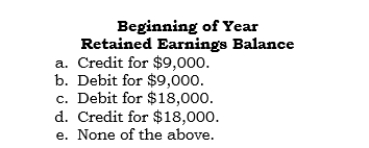

_____ On 1/1/06, Savtex, an Irish subsidiary of Pavtex, acquired a copyright for 100,000 LCU. Ireland's GAAP and income tax laws require amortization over no more than four years. Accordingly, Savtex uses a four-year life, even though the patent has a useful life of 10 years. Savtex's income tax rate is 40%. The worksheet adjusting entry required at 12/31/07 (not 2006) to restate to U.S. GAAP includes which of the following postings?

Correct Answer:

Verified

Q80: _ Pakex's French subsidiary, Sakex, sold inventory

Q81: _ Which of the following is the

Q82: _ On 12/31/06, a Danish subsidiary accrued

Q83: _ A Swiss subsidiary follows the practice

Q84: _ A Swiss subsidiary follows the practice

Q86: _ On 1/1/06, Savtex, an Irish subsidiary

Q87: _ On 1/1/06, a foreign unit of

Q88: _ Parco's foreign subsidiary had the following

Q89: _ Parrex has a foreign subsidiary, Sarrex,

Q90: _ Pemex's Swiss subsidiary, Semex, had stockholders'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents