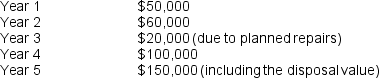

Madison Movers is considering investing in new trucks for their residential moving business. The investment will require an outlay of $180,000 initially, and is expected to generate the following after-tax cash flows:

The company uses a discount rate of 9%.

The company uses a discount rate of 9%.

What is the Net Present Value of the proposed investment? (Use the tables in Appendix A to determine the appropriate discount factor.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: TG Enterprises owns a small start-up company,

Q73: TG Enterprises owns a small start-up company,

Q74: IBBC Co. has additional funds that need

Q75: Harrison Co. has additional funds that need

Q76: Scription Inc. has additional cash available for

Q78: Lofty Expectations is considering purchasing a piece

Q79: SGM Corporation reported Sales of $100,000, Cost

Q80: SGM Corporation had after-tax cash flows related

Q81: SGM Corporation had pre-tax cash inflows of

Q82: Wylie Contracting Inc. (WCI) is a contracting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents