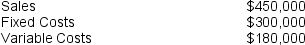

Glitter Inc. is a fashion designer company that serves both individuals and companies (mostly in the entertainment industry). Glitter recorded the following information for last month's transactions:

Projects in Process at the beginning of the month: 20 projects, 15% complete, with $30,000 of fixed overhead costs allocated.

Projects in Process at the beginning of the month: 20 projects, 15% complete, with $30,000 of fixed overhead costs allocated.

Projects in Process at the end of the month: 40 projects, 50% complete

All projects in process at the beginning of the month are considered completed by the end of the month, and costs are tracked for each project individually. This month, fixed overhead was allocated at a rate of $6,000/project (applied evenly over the production process).

Management is concerned about their costs, and wants to get a short-term bank loan-just enough to cover their variable operating loss from this past month while projects are completed. The bank requires Glitter to submit GAAP-compliant financial statements and will only grant a loan if they can show absorption operating income at least $15,000 greater than the loan requested.

Will Glitter be able to receive the loan needed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: How can variable costing lead to underpricing

Q76: How can variable costing mitigate the pressure

Q77: How might working capital be understated under

Q78: Why does variable costing cause the cost

Q79: Home Resorts, a residential pool installation company,

Q81: Organic Food Market (OFM) is a local

Q82: CES Inc. is considering obtaining a bank

Q83: Tropical Shelters, a pavilion installation company, is

Q84: Lotso Inc. is a toy design company

Q85: Shoots & Leaves, (SL), is a local

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents