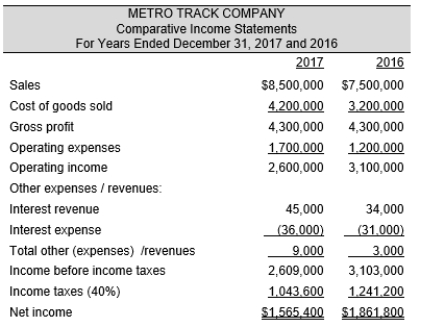

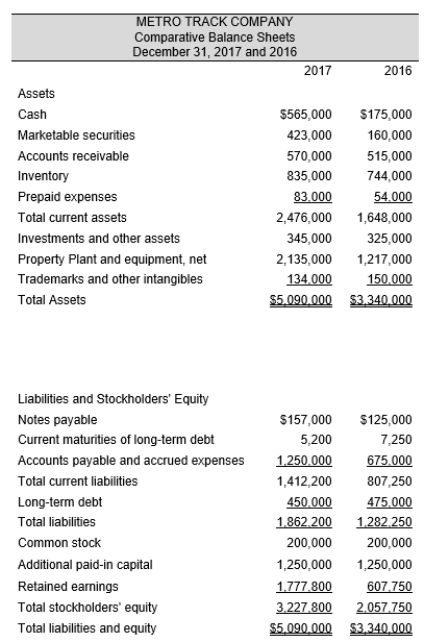

Comparative income statements and balance sheets for Metro Track Company follow for 2017 and 2016.

Required:

Required:

a. Prepare a comprehensive analysis of Metro Track for 2017 including the following measures (round all calculations to three decimal places.

1. Short-term solvency ratios (current ratio, acid test, inventory turnover, and days sales in receivables ratios)

2. Long-term solvency ratios (debt-to-equity and times-interest-earned ratios)

3. Performance measurement ratios (asset turnover, return on sales, return on assets, and return on equity ratios)

b. Comment on the financial condition of Metro Track with respect to short-term solvency, long-term solvency, and performance.

c. Using the data for Metro Track Company, prepare common size statements. For the balance sheets, use total assets as the base; for the income statements, make one set using sales of each year as the base and another set using the year 2016 as the base for both years.

d. Comment on the condition of Metro Track drawing on the common size statements.

Correct Answer:

Verified

Current...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Show the effect of each of the

Q81: Show the effect of each of the

Q82: In the spaces provided below, complete a

Q83: Indicate the type of each ratio listed

Q84: Select the ratio that each statement below

Q86: Explain the purpose for financial statement analysis

Q87: List and describe briefly the factors that

Q88: Explain the purpose of evaluation standards in

Q89: Explain the difference between solvency evaluation and

Q90: Explain the concept of financial leverage. What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents