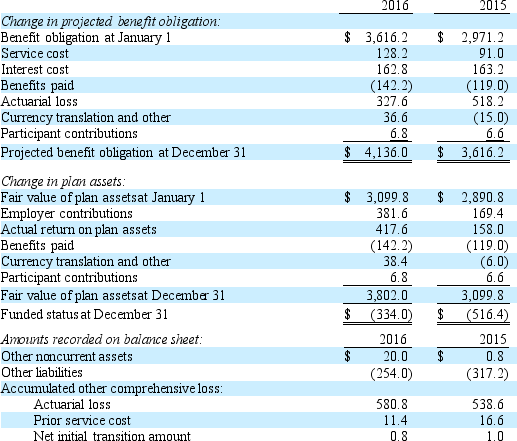

The following pension information was disclosed by Bloomington, Inc. (in millions)

A. What is "service cost"? How does it affect Bloomington's total pension expense for the year?

A. What is "service cost"? How does it affect Bloomington's total pension expense for the year?

B. Bloomington reports an actuarial loss of $327.6 million for 2016. What is this loss and how does Bloomington account for it?

C. How much did Bloomington contribute to the pension plan during 2016?

D. What amount of pension benefits were paid to former Bloomington employees during the year?

E. Explain the funded status of the pension plan in 2016 and compare it to the funded status in 2015. Are these amounts significant?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Festival Corp. disclosed the following lease information

Q45: The following is the leasing commitment information

Q46: DuPage Company is interested in leasing a

Q47: American Symbol Outfitters includes the following information

Q48: The following is an excerpt from the

Q49: M. A. Ivy Company reports the following

Q51: The following pension information was disclosed by

Q52: What are deferred taxes? When do they

Q53: Discuss the concept of "income smoothing" that

Q54: Discuss the various implications of the failure

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents