Following is an excerpt from a footnote from the Soft-Drink Company 2016 annual report:

NOTE10: DEBT AND BORROWING ARRANGEMENTS

Short-Term Borrowings

Loans and notes payable consist primarily of commercial paper issued in the United States. As of December 31, 2016 and 2015, we had $32,408 million and $24,270 million, respectively, in outstanding commercial paper borrowings. Our weighted-average interest rates for commercial paper outstanding were approximately 0.3 percent and 0.2 percent per year as of December 31, 2016 and 2015, respectively.

In addition, we had $15,536 million in lines of credit and other short-term credit facilities as of December 31, 2016, of which $1,708 million was related to the Company's consolidated Philippine bottling operations that were classified as held for sale. The Company's total lines of credit included $186 million that was outstanding and primarily related to our international operations.

Included in the credit facilities discussed above, the Company had $12,628 million in lines of credit for general corporate purposes. These backup lines of credit expire at various times from 2017 through 2021. There were no borrowings under these backup lines of credit during 2016. These credit facilities are subject to normal banking terms and conditions. Some of the financial arrangements require compensating balances, none of which is presently significant to our Company.

Long-Term Debt

During 2016, the Company retired $2,500 million of long-term notes upon maturity and issued $5,500 million of long-term debt. The general terms of the notes issued are as follows:

●$2,000 million total principal amount of notes due March 14, 2018, at a variable interest rate equal to the three-month London Interbank Offered Rate ("LIBOR") minus 0.05 percent;

●$2,000 million total principal amount of notes due March 13, 2019, at a fixed interest rate of 0.75 percent; and

●$1,500 million total principal amount of notes due March 14, 2022, at a fixed interest rate of 1.65 percent.

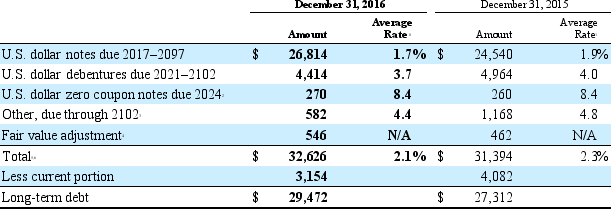

The Company's long-term debt consisted of the following (in millions, except average rate data):

Maturities of long-term debt for the five years succeeding December 31, 2016, are as follows (in millions):

Maturities of long-term debt for the five years succeeding December 31, 2016, are as follows (in millions):

The cash flows from financing activities section of Soft-Drink Company's 2016 annual report contains the following cash flows provided by (used by) activities (in millions):

The cash flows from financing activities section of Soft-Drink Company's 2016 annual report contains the following cash flows provided by (used by) activities (in millions):

A. What amount was issued in the form of debt in 2016? 2015?

A. What amount was issued in the form of debt in 2016? 2015?

B. Does Soft-Drink Company finance its activities primarily through short-term or long-term debt?

C. Based on the info above, what are the details of the long-term debt issuance for 2016?

D. How would the issuance of debt in 2016 be reflected on the financial statements for The Soft-Drink Company?

E. How would the payments of debt affect the financial statements in 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The following data relates to Beluga Company

Q49: Rural Roads Company has the following values

Q50: Cat Chow Corp. recently issued bonds with

Q51: Renegade Corporation issued $60,000,000 in bonds which

Q52: Following are the liability and equity sections

Q54: Roaring Rapids Adventures is short on cash,

Q55: You are a pension fund manager looking

Q56: What are the requirements for determining the

Q57: The following table lists some bond rankings:

Q58: Explain the differences in the components of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents