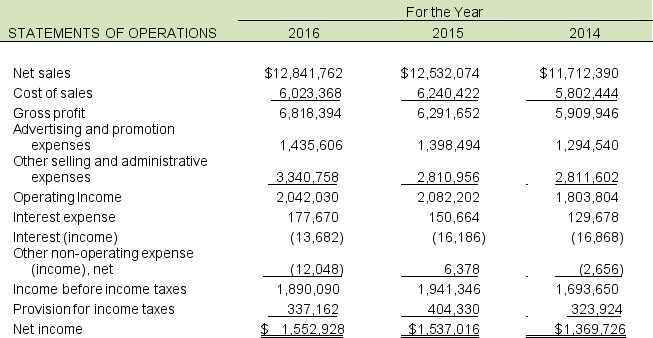

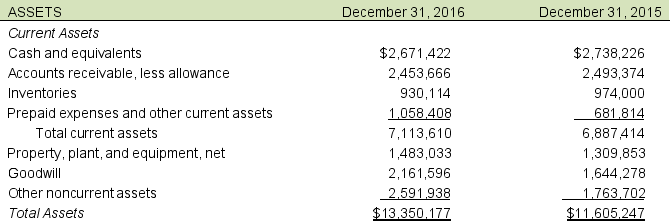

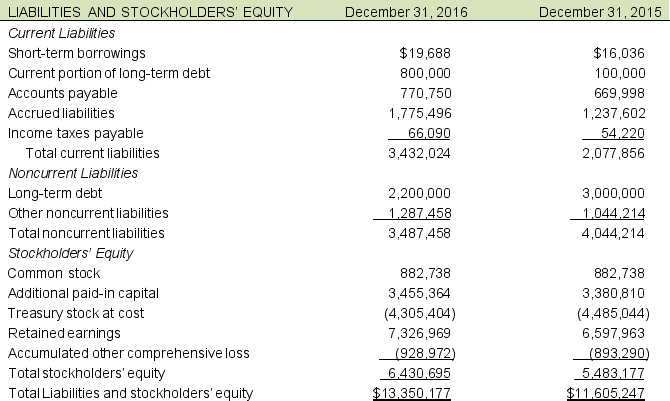

The following income statements, balance sheets, and plant asset disclosures are presented by Terrific Toys, Inc., a toy manufacturer, in its 2016 annual report.

Terrific Toys, Inc.'s plant asset note disclosure follows:

Property, Plant, and Equipment

Property, plant, and equipment are stated at cost less accumulated depreciation and amortization. Depreciation is computed using the straight-line method over estimated useful lives of 10 to 30 years for buildings, 3 to 10 years for machinery and equipment, and 10 to 20 years, not to exceed the lease term, for leasehold improvements. Tools, dies, and molds are amortized using the straight-line method over 3 years. Estimated useful lives are periodically reviewed and, where appropriate, changes are made prospectively. The carrying value of property, plant, and equipment is reviewed when events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. Any potential impairment identified is assessed by evaluating the operating performance and future undiscounted cash flows of the underlying assets. When property is sold or retired, the cost of the property and the related accumulated depreciation are removed from the consolidated balance sheet and any resulting gain or loss is included in the results of operations.

A. Compute property, plant, and equipment turnover (PPET) (disregard Other Noncurrent Assets) for 2016 and 2015. Property, plant and equipment, net for 2014 was $1,211,763. Is there any significant change? What assets may not be reflected on Terrific Toys' balance sheet?

B. When does Terrific Toys check for asset impairment? What process do they use to assess impairment? Does this follow GAAP guidelines? Do these charges affect cash flows? How should these charges be treated for analysis purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The following information is reported for the

Q49: Oil Rig Company estimated that the oil

Q50: In 2015, Marvin's Mining Company purchased land

Q51: Marvelous Materials presented the following partial balance

Q52: Consider the following schedule from a footnote

Q53: Following are selected financial information from Foster

Q54: Following is financial information (millions) from Tractor

Q56: The following are the income statement and

Q57: What are the main issues in reporting

Q58: Explain the considerations a CFO would make

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents