Use the following information for questions below:

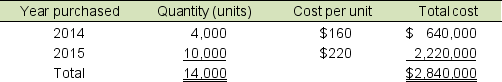

Wonderland Company imports and sells a product produced in Canada. In the summer of 2016, a natural disaster disrupted production, affecting its supply of product. On January 1, 2016, Wonderland's inventory records were as follows:

Through mid-December of 2016, purchases were limited to16,000 units, because the cost had increased to $320 per unit. Wonderland sold 18,400 units during 2016 at a price of $392 per unit, which significantly depleted its inventory.

Through mid-December of 2016, purchases were limited to16,000 units, because the cost had increased to $320 per unit. Wonderland sold 18,400 units during 2016 at a price of $392 per unit, which significantly depleted its inventory.

-Assume that Wonderland purchases 22,800 more of the $320 units on December 31, 2016. Wonderland uses the FIFO inventory method.

Compute Wonderland's gross profit for 2016.

A) $2,964,800

B) $2,044,800

C) $2,073,200

D) $1,714,400

Correct Answer:

Verified

Q26: The following data refer to Sean Company's

Q27: The following hammers were available for sale

Q28: The following hammers were available for sale

Q29: If inventory at the end of the

Q30: Use the following information for questions below:

Q32: The following amounts and costs of platters

Q33: The following amounts and costs of platters

Q34: Felix Inc. owes $80,000 to Cat, Inc.

Q35: Complete the grid to calculate Cost of

Q36: Yellow Star Software Company's 2016 balance sheet

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents