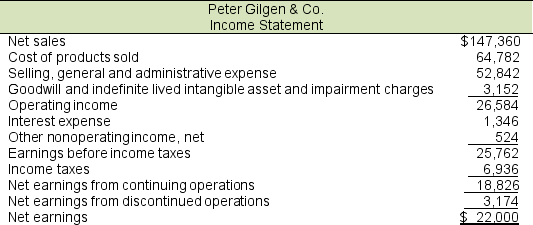

Peter Gilgen & Co.'s (PG & Co.) recent balance sheet (fiscal year 2016) reported average equity of $112,036 and average total assets of $240,598. Assume that the company's statutory tax rate is 35%. PG & Co.'s recent income statement showed the following):

A. Calculate the income tax rate on earnings before income taxes.

A. Calculate the income tax rate on earnings before income taxes.

B. How much is EWI?

C. Calculate ROE and ROA.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Use the following selected balance sheet and

Q24: Use the following selected balance sheet and

Q25: Use the following selected balance sheet and

Q26: Walkie Enterprises reported sales revenue totaling $1,120,000,

Q27: Selected balance sheet and income statement information

Q29: Selected balance sheet and income statement information

Q30: Selected balance sheet and income statement information

Q31: Selected 2016 balance sheet and income statement

Q32: Selected 2016 balance sheet and income statement

Q33: Selected recent balance sheet and income statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents