The income statements for Bullseye Corporation for fiscal years 2015, 2014, and 2013 follow:

Prepare a pro-forma income statement for 2016 for Bullseye assuming the following:

Prepare a pro-forma income statement for 2016 for Bullseye assuming the following:

A. Total revenues are $142,000 million.

B. Cost of sales is 68% of net sales.

C. Selling, general and administrative expenses increase by 10% from 2015. Credit card expense increases by 12%.

D. Depreciation increases by 5%

E. There is no gain on receivables held for sale.

F. Interest costs remain the same.

G. The effective income tax rate is 35%.

Correct Answer:

Verified

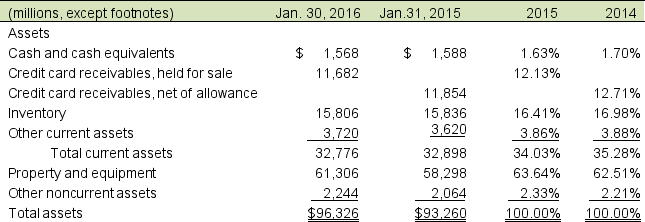

Q41: Selected balance sheet and income statement information

Q42: Selected 2016 balance sheet and income statement

Q43: The balance sheets and income statements for

Q44: Selected balance sheet and income statement information

Q45: The partial balance sheets and income statements

Q46: The income statements for Bullseye Corporation for

Q48: The balance sheets for Bullseye Corporation for

Q49: Explain the trade-off between profit margin and

Q50: Discuss factors that limit the usefulness of

Q51: Ratio analysis is more complicated when a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents