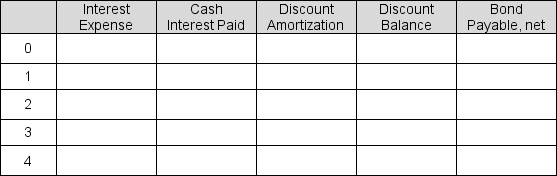

Gold Enterprises recently issued $40 million of 12% coupon bonds, payable semiannually, which mature in 10 years. The bonds were sold for $37,796,299 to yield a 13% annual rate.

Use the table below to show the amortization of the discount, interest expense, and the carrying amount of the bonds from issuance till the end of Period 4.

Correct Answer:

Verified

Q54: Weiss Corporation's 2017 financial statements yield the

Q55: Merck & Co. included the following footnote

Q56: Following is a footnote for Abbott Laboratories

Q57: The Progressive Corporation (a property and casualty

Q58: Progressive Corporation (a property and casualty insurance

Q60: Following is the debt footnote from the

Q61: Progressive Corp. (a property and casualty insurance

Q62: What determines the effective cost of debt?

Q63: What is the difference between the reported

Q64: What are some ratios used by Moody's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents