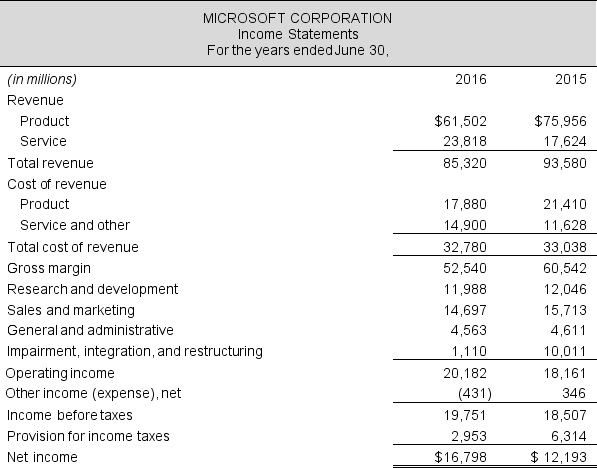

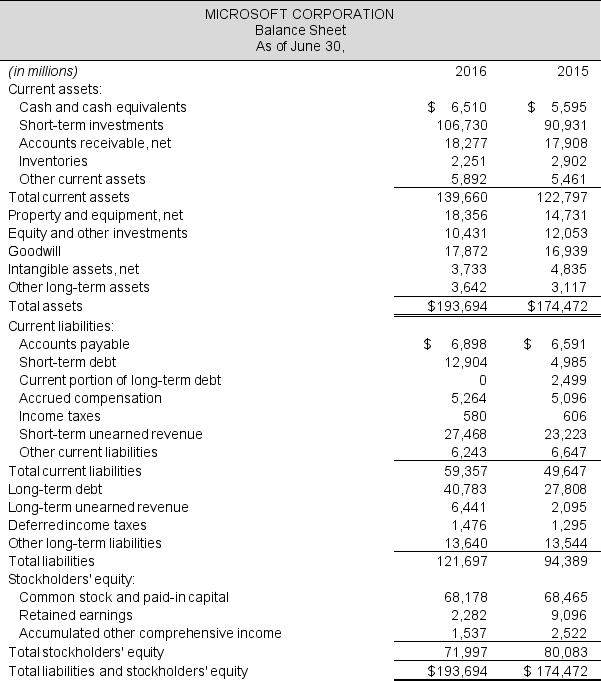

Income statements and balance sheets follow for Microsoft Corporation. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets (RNOA) is 109.1% and 52.6% in 2016 and 2015, respectively. NNO were $(63,064) million in 2014.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations (assets) were $(63,064) million and shareholders' equity was $89,784 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread). Interpret the year-over-year change in ROE.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Income statements and balance sheets follow for

Q54: Income statements and balance sheets follow for

Q55: Income statements and balance sheets follow for

Q56: Income statements and balance sheets follow for

Q57: Income statements and balance sheets follow for

Q59: Income statements and balance sheets follow for

Q60: Income statements and balance sheets follow for

Q61: Use the following balance sheets and income

Q62: Explain the trade-off between net operating profit

Q63: Explain how return on net operating assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents