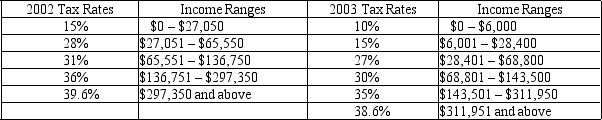

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.What type of tax structure does the United States have in 2003 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

Correct Answer:

Verified

Q114: Table 12-2

United States Income Tax Rates for

Q158: An efficient tax system is one that

Q187: In the absence of taxes,Janet would prefer

Q281: A tax system with little deadweight loss

Q282: In designing a tax system, policymakers have

Q290: Which of the following is a characteristic

Q291: The deadweight loss of a tax is

A)the

Q303: Deadweight losses occur in markets in which

A)firms

Q307: When taxes are imposed on a commodity,

A)there

Q366: Part of the administrative burden of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents