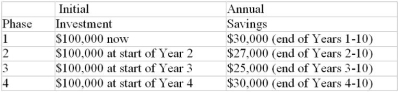

An automotive parts plant is scheduled to be closed in 10 years. Nevertheless, its engineering department thinks that some investments in computer controlled equipment can be justified by savings in labour and energy costs within that time frame. The engineering department is proposing a four phase capital investment program:

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: A real estate salesperson can lease an

Q9: A college can purchase a telephone system

Q10: Rocky Mountain Bus Tours needs an additional

Q11: Ralph Harder has been transferred to Regina

Q12: St. Lawrence Bus Lines is offered a

Q14: The pro forma projections for growing a

Q15: A proposed strip mine would require the

Q16: The development of a new product will

Q17: The introduction of a new product will

Q18: Jasper Ski Corp. is studying the feasibility

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents