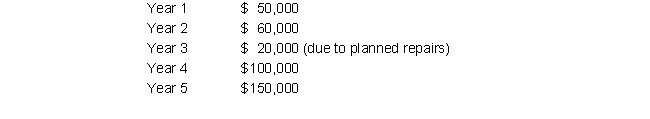

Hilltop Moving Company is considering investing in 2 new trucks for their residential moving business. The investment will require an outlay of $190,000 initially, and is expected to generate the following pre-tax cash flows:

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

The trucks would be fully depreciated on a straight-line basis over the course of 5 years, with a full year of depreciation taken in the first year. Even though they will be fully depreciated, the company expects to be able to sell the trucks for $20,000. The company uses a discount rate of 9%, and pays a marginal tax rate of 25%.

What is the Average Rate of Return of this proposed investment? (Round to 4 decimal places)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Shumer Inc. is a construction company that

Q5: Shumer Inc. is a construction company that

Q6: Scription Inc. has additional cash available for

Q7: Wylie Contracting Inc. (WCI) is a contracting

Q8: Hilltop Moving Company is considering investing in

Q10: InterCont is a construction company that plans

Q11: InterCont is a construction company that plans

Q12: Starsky is a research company that plans

Q13: Starsky is a research company that plans

Q14: Jon Blue owns a small start-up company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents