GoodWash Co. is a dishwasher manufacturing company. GoodWash is considering purchasing a new piece of manufacturing equipment for $800,000. The equipment is expected to last for 8 years, and management projects that purchasing the equipment would result in an additional $150,000 in pre-tax cash flow per year. Management does not expect the equipment to have any value at the end of 8 years, and so will fully depreciate the equipment on a straight-line basis.

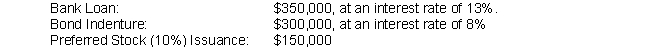

To obtain the funds to purchase this equipment, GoodWash plans to raise capital from the following sources:

GoodWash's tax rate is 30%.

GoodWash's tax rate is 30%.

What is the Net Present Value of the proposed investment? Use a financial calculator to compute the Present Value of the future cash flows.

Correct Answer:

Verified

Bank ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Atas Threads (AT) is a textile wholesale

Q18: Ikan Fishery, a local fish farm, is

Q19: Jensen Co. has additional funds available for

Q20: MRM Inc. has additional cash available for

Q21: What is meant by the term "capital

Q22: What is the cost of capital?

Q23: Arbitrary Inc. has is planning to purchase

Q24: Local Grown Inc., a local plant nursery,

Q26: Batter Than Bacon, a local waffle shop,

Q27: BonClyde Co. is planning to purchase an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents