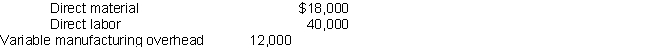

Christensen Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000 feet of one inch strips annually for $72,000. Variable costs for the leather strips are as follows: Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

What would the annual incremental income or loss be if Christensen produces the bridles?

A) $ 700 incremental income

B) $ 700 incremental loss

C) $1,800 incremental income

D) $1,800 incremental loss

E) None of the above

Correct Answer:

Verified

Q1: Sunk costs are those costs that have

Q2: Operating results for Division A of Alpha

Q3: Scott Corporation produces a part that is

Q4: DJH Enterprises has 3 departments. Operating results

Q5: DJH Enterprises has 3 departments. Operating results

Q7: Earthworks Co. produces three products from a

Q8: All Terrain Tires manufactures three different off-road

Q9: All Terrain Tires manufactures three different off-road

Q10: JetTaxi is a passenger airplane line that

Q11: Fizzy Drinks Co. produces a soft drink

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents