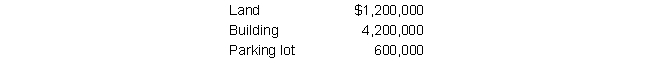

Henry Company purchased a property (including land and building) . The company acquired the property in exchange for a 15-year mortgage for $5,400,000. Their insurance company appraised the components as follows: What should be the cost basis for the building?

What should be the cost basis for the building?

A) $3,780,000

B) $3,000,000

C) $3,600,000

D) $3,633,333

Correct Answer:

Verified

Q65: Grove Company's 2019 asset turnover was 3.0.

Q66: Tiffany Company's 2019 asset turnover was 3.0.

Q67: Nutgum Company made a package purchase of

Q68: Taffy Company made a package purchase of

Q69: Hubert Company purchased a property (including land

Q71: Caesar Company bought a machine on January

Q72: Apple Company bought a machine on January

Q73: Jafari Corporation purchased a truck at the

Q74: Arabia Corporation purchased a truck at the

Q75: On April 30, 2019, Macy Products purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents