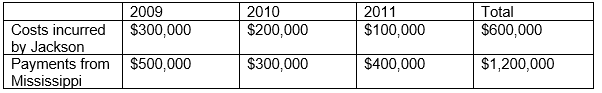

Jackson Construction built a levee for the state of Mississippi over a three-year period.The contracted price for the levee was $1,200,000.The costs incurred by Jackson and the payments from the state over the three year period are as follows:

- If revenue is recognized when payments are received, which of the following present the net income amounts reported in 2009, 2010, and 2011, respectively?

A) $500,000; $300,000; $400,000

B) $200,000; $100,000; $300,000

C) $400,000; $400,000; $400,000

D) $300,000; $200,000; $100,000

Correct Answer:

Verified

Q2: Ramos Company ordered 500 toy wagons from

Q3: Ramos Company ordered 500 toy wagons from

Q4: Ramos Company ordered 500 toy wagons from

Q5: On October 1, 2010, $18,000 of annual

Q6: On October 1, 2010, $18,000 of annual

Q8: Jackson Construction built a levee for the

Q9: Liabilities are $2,000, retained earnings are $1,000,

Q10: During April, Giselle Corp.paid $3,000 on account

Q11: Guadalupe Company sold stock for cash and

Q12: The statement of cash flows (direct method)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents