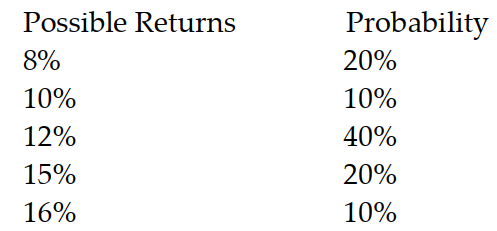

What is the expected return given the following information?

A) 0.12%

B) 12%

C) 18.2%

D) 12.2%

Correct Answer:

Verified

Q2: Standard deviation is a:

A) numerical indicator of

Q3: A risk averse manager:

A) will take a

Q4: If the distribution of possible future sales

Q5: What is the standard deviation of the

Q6: What is the coefficient of variation of

Q8: When we compare the risk of two

Q9: You are trying to diversify your portfolio

Q10: The beta of the market is:

A) 2

B)

Q11: The coefficient of variation is best represented

Q12: Business risk is best measured after the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents