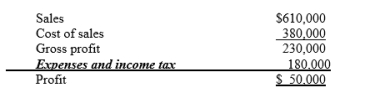

The income statement for the Yarrah Ltd for the year ended 31 December 2020 appears below.

*Includes $30,000 of interest expense and $16,000 of income tax expense.

*Includes $30,000 of interest expense and $16,000 of income tax expense.

Additional information:

1. Ordinary shares outstanding on 1 January 2020 was 50,000 shares. On 1 July 2020

10,000 more shares were issued.

2. The market price of Yarrah shares was $12 at the end of 2020.

3. Cash dividends of $30,000 were paid, $6,000 of which were paid to preferred shareholders.

Compute the following ratios for 2020:

(a) earnings per share

(b) price-earnings ratio

(c) times interest earned.

Correct Answer:

Verified

Q17: The financial statements of Bloggs Ltd appear

Q18: The following ratios have been computed for

Q19: Selected data for Marcy's Apparel appear below.

Q20: Willow Ltd has issued ordinary shares only.

Q21: Birch Ltd had the following comparative current

Q23: Complete the following statements:

-If the inventory turnover

Q24: Complete the following statements:

-Hansen Company reported profit

Q25: For each of the ratios listed ,

Q26: For each of the ratios listed ,

Q27: For each of the ratios listed ,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents