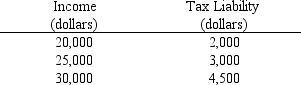

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

A) 10 percent.

B) 12 percent.

C) 20 percent.

D) 30 percent.

Correct Answer:

Verified

Q133: When a tax is levied on the

Q142: Kathy works full time during the day

Q142: An income tax is proportional if

A) the

Q143: An income tax is defined as regressive

Q146: An income tax is progressive if the

A)

Q147: Ron works full time as a teacher

Q151: A tax for which the average tax

Q152: Susan works as an advertising executive for

Q153: Kathy works full time during the day

Q154: A progressive tax is defined as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents