Nancy just inherited $83,000. She decides to diversify her investment by putting the money into three different accounts: tax-free bonds which pay 5% annual interest, a certificate of deposit which pays 7% annual interest, and a mutual stock fund which has an average annual rate of return of 12%. The amount she invests in the certificate of deposit is double the amount she invests in bonds. Her goal for total return per year from these three investments is $7720. How much should Nancy put into each account?

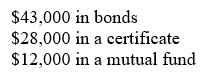

A)

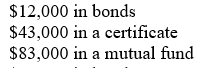

B)

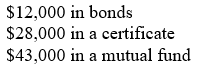

C)

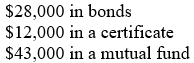

D)

E) none of these

Correct Answer:

Verified

Q38: Solve the system of equations using elimination,

Q39: Solve the system of equations using elimination,

Q40: Solve the system of equations using elimination,

Q41: Solve the system of equations using elimination,

Q42: Solve the system of equations using elimination,

Q44: In the Storms baseball stadium, there are

Q45: Morgan is keeping track of her calcium

Q46: A company that manufactures gas grills sells

Q47: A company that manufactures gas grills sells

Q48: Chloe decides to open a lemonade stand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents